Hello my fellow finance aspirants. I welcome you to my blog. I am getting very excited to take you through this journey. Where we will know what IPO is and how it works.

You are also excited to know “What is an IPO?”. So let’s start your IPO knowledge journey.

Definition of IPO (Initial Public Offering):

An initial public offering (IPO) is a method by which a non-public employer sells shares of its inventory to the public for the first time. This allows the corporation to raise capital from a variety of buyers and become a publicly traded agency. IPOs are often seen as a milestone for corporations, as they can provide assets to expand operations, expand new merchandise, and grow market share.

Some detailed explanation about “What is an IPO (Initial Public Offering)?”:

Planning and Preparation:- The organization decides to move public and hires investment banks to manipulate the IPOs process. Investment banks draw with an organization to prepare an IPO prospectus, a report containing unique information about a corporation’s financial performance, business approach and risks.

Bookbuilding:- Funding banks gauge investor interest in an IPO using a completed road show, which can be shown to institutional buyers. Based on the interest cap, the funding banks decide the IPO price, which is the price at which the shares can be offered to the general public.

Pricing And Allocation:- The IPOs charge is introduced, and the shares are allocated to institutional buyers. The organization receives the proceeds from the sale of the shares, and the shares begin trading on a stock change.

Significance of IPOs in financial market

Initial public offerings (IPOs) continue to play an important role in the financial markets, playing an essential role in the growth and improvement of institutions and the general health of the economy. Here are some key elements that highlight the importance of an IPOs.

Capital raising and economic growth:- IPOs provide a mechanism for non-public companies to access a large pool of capital from the public, allowing them to fund expansion plans, studies and improvement projects, and well-known business operations. This flow of capital fuels financial growth through stimulating work introductions, innovation and market expansion.

Market Efficiency and Liquidity:- IPOs contribute to market efficiency by introducing new funding opportunities to the public, broadening the investor base and improving the overall liquidity of the stock marketplace. This helps in the pursuit of increased liquidity fees, allowing market forces to more accurately reflect the true value of corporations.

Wealth Creation and Risk Management:- IPOs can generate extensive wealth for early investors, venture capitalists and employer founders as they provide an exit strategy to monetize their holdings and earn a return on their investment. However, it is important to observe that IPOs also present inherent risks, and buyers should carefully check their risk tolerance before participating.

Performance benchmarks and investor confidence:- IPOs performance serves as a benchmark to compare the overall fitness of the stock market and the economy. A successful IPO signals investor confidence and financial optimism, while a poor IPO performance can indicate broader market concerns.

Entrepreneurial ecosystem and innovation:- IPOs encourage innovation and entrepreneurship by providing an avenue for organizations to raise capital and gain public recognition. This fosters a vibrant entrepreneurial environment that drives financial growth and social development.

Corporate governance and transparency:- Publicly traded businesses are subject to strict corporate governance requirements and multiply transparency, increasing investor safety and selling ethical business practices.

Public Participation and Economic Empowerment:- IPOs allow the general public to participate in the ownership and growth of successful groups, democratizing wealth creation and promoting an experience of economic empowerment.

Market Depth and Diversification:- IPOs introduce new businesses and industries to the stock market, increasing marketplace intensity and providing investors with a wider variety of investment options, which can complement portfolio diversification and threat control techniques.

Global Financial Landscape and International Investments:- IPOs facilitate cross-border investments, allow companies to raise capital from international buyers and expand their international reach. This contributes to the interconnectedness of the global financial landscape.

Economic Vitality and Market Sentiment:- The overall level of IPO activity serves as an indicator of financial vitality and marketplace sentiment. A surge in IPOs regularly reflects financial boom and optimism, while a slowdown in IPO interest can mimic broader financial concerns.

Overview of the IPO Process

Pre-IPO Stage

The pre-IPOs stage, also called the pre-IPO transformation level, is the initial segment of the IPO process in which an individual corporation lays the groundwork for becoming publicly traded. This stage includes a comprehensive assessment of the economic viability of the enterprise, business enterprise methodology and overall readiness for the general public market.

Key activities during the pre-IPO stage include:-

- Company Decision to Go Public

- Engagement of Investment Banks

- Preparation of IPOs Prospectus

- Due Diligence and Regulatory Review

- Pre-Marketing and Roadshows

- Valuation and Pricing

- Finalization of IPOs Documents

- SEC Filing

- Marketing and Investor Outreach

- Bookbuilding and Order Gathering

The pre-IPO degree is an important period that determines the level for a hit IPO. By carefully preparing the necessary documents, engaging in thorough due diligence and engaging in vigorous pre-advertising sports, organizations can increase their chances of a hit IPO and achieve their fundraising goals.

Bookbuilding and Pricing

Bookbuilding and pricing are two important steps in an initial public presenting (IPO) system. Book building is a technique by which funding banks receive bids from institutional buyers to determine the IPOs rate, as pricing involves determining the last rate at which shares can be offered to the general public.

Bookbuilding process

Price range announcement: The corporation and its underwriters announce the charge range in which they expect the stock to be offered. This category reflects their assessment of the company’s value and investor demand.

Institutional Investor Bids: Institutional investors submit bids, specifying the number of shares they want to buy and their preferred fee in the variety presented. This bid indicates their willingness to pay for the shares.

Assessing Demand: Underwriters collect and test bids, evaluating common phase and rate factors for calls at which buyers are most interested in purchasing shares.

Determination of cut-off price: Based on the call for valuation, the underwriters determine the cut-off price, which is the rate at which all bids below that charge will not be completed. Low-off fees are usually set at or near the fee factor where demand is highest.

Allotment of shares: Underwriters allocate stocks to institutional investors based on their bids, taking into account their order size, their funding records and their commitment to hold the stock for a certain length of time.

Pricing

Final Price: The final IPOs charge is prepared at or near the cut-off rate, which reflects the equilibrium point at which supply and call converge. This charge is considered as the maximum attractive rate for each enterprise and investors.

Public Offering: Once the final charge is decided, the IPOs is officially released, and the stock is offered to the general public on the market through a number of channels, brokerages and online buying and selling platforms.

Importance of Bookbuilding and Pricing

Bookbuilding serves as a fee discovery mechanism, allowing the market to determine the true fee for the employer’s shares, which is primarily based on investor demand.

By collecting bids and assessing demand, underwriters aim to set fees that are neither too low (underpriced) nor too high (overpriced), ensuring that both the business enterprise and investors receive true value.

The bookbuilding process secures commitments from institutional buyers, presenting the business enterprise with a fixed phase of capital raising.

The IPOs fee sets the initial reference point for buying and selling an enterprise’s shares on the general public market.

Overall, bookbuilding and pricing play a critical role in the IPO process, ensuring that an enterprise’s shares are offered at a price that reflects market demand and maximizes the company’s capital raising aspirations.

Listing and Trading

Listing and buying and selling is the final stage of the initial public offering (IPOs) process, in which the employer’s shares officially start buying and selling on the public inventory exchange.

listing

Selection of stock exchange: The employer and its underwriters select the appropriate stock exchange for listing, considering elements such as market reach, buying and selling volume and visibility.

Application for listing: A corporation submits a software to a selected inventory exchange, which provides targeted information about its overall economic performance, business operations and corporate governance practices.

Regulatory Review and Approval: Stock Change conducts an intensive review of enterprise utility and documentation, ensuring compliance with listing requirements and regulatory standards.

Bell Ringing Ceremony: After approval, the corporation’s stocks are officially listed on the stock exchange, often marked by a ceremonial bell ringing ceremony.

Ticker Symbol Assignment: A business enterprise is assigned a unique ticker image, a short identifier used to symbolize its shares upon stock exchange.

Trade

Initial pricing: The initial trading fee of a stock is determined by an auction, in which buyers and sellers place orders around different fee factors.

Market Making: Market makers, specialized companies, provide liquidity by continuously placing orders to buy and sell shares, maintaining a smooth and orderly trading system.

Supply and Demand Dynamics: Percentage prices fluctuate throughout the trading day based entirely on supply and call for factors, driven by investor sentiment, information events and general market conditions.

Shareholder Rights: As public shareholders, traders receive voting rights, which enable them to participate in company governance choices. They also receive dividends, which are part of the agency’s income.

Market Performance and Valuation: A corporation’s share price will be a key indicator of its market performance and standard valuation, which will reflect investors’ perception of its future growth prospects.

Importance of listing and trading

Public accessibility: Listing on a public exchange makes agency shares accessible to a wider range of traders, including retail and institutional buyers.

Enhanced Liquidity: Trading on public exchanges introduces liquidity to stocks, allowing investors to buy and sell easily.

Increased market visibility: Listing and trading boosts the employer’s public profile, attracting new investors and partners.

Access to additional capital: Publicly traded groups can raise additional capital through secondary services, issuing more stock to existing or new traders.

Performance Benchmarking: A company’s inventory ratio serves as a benchmark for evaluating its overall financial performance and for evaluating enterprise peers.

Overall, listing and trading are important steps in the IPO process, allowing groups to gain access to a broader investor base, improve liquidity, and raise additional capital for growth and expansion.

Roles of Key Players in IPOs

- Investment banks:- Investment banks play an important role in the Preliminary Public Offering (IPOs) system, serving as the go-public agency and intermediary in taking investments public. Their multifaceted duties include various aspects of IPOs, from underwriting and pricing to marketing and allotment of shares.

- Underwriting:- Investment banks act as underwriters, guaranteeing to buy a positive number of shares from the institution at an agreed IPOs rate, regardless of market demand. This underwriting commitment ensures that the corporation receives meaningful capital even if public demand declines faster than expected.

- Pricing and risk assessment:- Investment banks employ their expertise in financial valuation and market assessment to determine the peak IPO fee, balancing the company’s fundraising needs with investor expectations. They also pay close attention to the risks of the agency’s financial fitness, business potential and ability to convey their pricing preferences.

- Marketing and Distribution:- Investment banks lead advertising and marketing marketing campaigns for IPOs, leveraging their significant networks and relationships with institutional investors to generate interest and entice potential clients. They prepare road shows, shows and investor conferences to showcase the enterprise’s funding capability and collect orders from institutional traders.

- Allocation and stabilization:- Following the manner of book building, funding banks primarily allocate shares among institutional traders based on their order and opportunity profile. They also engage in stabilization activities, which include buying and selling shares in the open market to smooth out rate fluctuations and keep stock prices at or near the IPOs price.

- Listing and ongoing support:- Investment banks facilitate the listing of the employer’s shares on inventory trade and provide ongoing support to ensure a smooth transition to the common public market. They can also act as market makers, providing liquidity by using continuous supply to buy and promote stocks on the open market. In return for his or her offering, the funding banks earn a fee, usually one percent of the entire IPO. The length of the charge depends on the complexity of the IPO and the overall risk profile of the enterprise.

Securities and Exchange Commission (SEC)

The Securities and Exchange Commission (SEC) is an impartial federal agency responsible for protecting traders, maintaining fair, orderly and green markets and facilitating capital formation. Established in 1934 in response to the stock market crash of 1929, the SEC is responsible for regulating securities enterprises and the U.S. Plays an important role in safeguarding the integrity of monetary gadgets.

Key Roles of SEC

Investor Protection: The SEC’s number one challenge is to protect buyers from fraud, manipulation and unfair practices in the securities markets. This includes enforcing securities legal guidelines, conducting investigations and taking enforcement action against violators.

Market Supervision: The SEC supervises securities exchanges, agents, dealers, investment advisers and mutual funds to ensure fair and orderly trading practices. It also regulates the issue and sale of securities along with IPOs to protect investors from misleading facts and unfair pricing.

Facilitation of capital formation: The SEC promotes capital formation by facilitating the flow of capital for corporations and by allowing agencies to raise money through public services. It also supports innovation and entrepreneurship by promoting a regulatory environment that encourages investment in new ventures.

Certain Responsibilities of the SEC

Enforcement of securities laws: The SEC enforces a broad set of federal securities laws, including the Securities Act of 1933 and the Securities Exchange Act of 1934. These laws regulate the issue, trading and advertising of securities to protect buyers and maintain market integrity.

Conducting Investigations: The SEC investigates suspected violations of securities laws, such as insider trading, accounting fraud, and manipulative buying and selling practices. It has the power to subpoena documents, interview witnesses and file civil or criminal charges against violators.

Regulation of Exchanges and Brokers: The SEC oversees the operations of securities exchanges, agents, and dealers to ensure compliance with securities laws and correct trading practices. It also regulates the use of margin accounts, short selling and other trading sports.

Regulation of investment advisers: The SEC regulates the game of investment advisers, who provide fund advice or recommendations to clients. It requires advisers to register with the SEC, disclose their expenses and hobby conflicts, and adhere to fiduciary standards.

Oversight of Mutual Funds: The SEC oversees the performance of mutual funds, which can be funding pools that spend money on various portfolios of securities. It calls for mutual finance to offer investors with clear disclosure about their fund’s objectives, risks and overall performance.

Educating Investors: The SEC offers instructional resources and investor pointers to help people make informed investment choices and protect themselves from fraud. It also conducts outreach applications to reach underserved communities and sell financial literacy.

Impact of SEC

SEC filings have a significant impact on the U.S. economic system by:

Promoting Investor Confidence: By protecting investors from fraud and ensuring truthful markets, the SEC promotes investor confidence and encourages participation in the securities markets.

Enhancing market efficiency: The SEC’s regulatory oversight promotes efficient markets by reducing statistical asymmetries and facilitating fee discovery.

Support capital formation: The SEC’s framework for securities issuance and market regulation allows for capital formation and allows agencies to access capital for growth and innovation.

Protecting the Monetary Machine: The SEC’s position in protecting the integrity of the securities markets contributes to the stability and resilience of the US monetary system.

The SEC’s work is essential to keeping securities markets fair and orderly, protecting traders, and promoting capital formation, which is critical to a healthy and vibrant economy.

Law Firms and Audit Firms

Law firms and audit firms play an important role in initial public offering (IPO) techniques, providing knowledge and guidance to businesses looking to go public.

Law firms

Law firms provide prison recommendations to groups at certain stages of the IPO process, advising on a variety of topics, such as:

IPO Structure and Compliance with Securities Laws: Law firms advise companies on the most appropriate IPO structure, ensuring compliance with complex securities laws and guidelines.

Drafting IPO Documents: Law firms draft a complete IPO prospectus, a report that outlines the business enterprise’s financial performance, business model, risks, and proposed terms of the IPO.

Regulatory Filings and SEC Review: Law firms assist organizations in preparing and filing regulatory filings with the Securities and Exchange Commission (SEC), ensuring accuracy and compliance.

Due Diligence and Legal Investigation: Law firms conduct thorough due diligence on the employer’s criminal and financial affairs, detect potential risks and ensure investor protection.

Negotiations with Underwriters: Law Firms represent the agency in negotiations with investment banks, negotiate the terms of underwriting settlements and ensure a suitable remedy for the organization.

Corporate Governance and Disclosure: The Law Corporations advocates companies on corporate governance practices and ensures compliance with disclosure requirements for publicly traded agencies.

Post-IPO Legal Support: Law firms continue to provide ongoing criminal advice to enterprises after an IPO, addressing ongoing regulatory compliance, securities law matters and company transactions.

Audit firms

Audit corporations play an important role in providing an unbiased warranty on an organization’s financial statements, ensuring the accuracy and reliability of information provided to investors.

Pre-IPO audit and accounting advice: Audit firms work with the agency to put together its financial statements for the IPO, comply with accounting requirements and identify potential accounting pitfalls.

Audit of financial statements: Audit firms rigorously audit an organization’s financial statements, providing an independent opinion on their fairness and accuracy.

Internal Control Evaluation: Audit firms evaluate an agency’s internal control over financial reporting, evaluating the effectiveness of controls in preventing and detecting fraud or errors.

Reporting and Disclosure: Audit firms issue audit reviews that are blank within the IPO prospectus, supplying buyers with a guarantee on the corporation’s financial condition and performance.

Ongoing Audit Services: Audit corporations maintain providing ongoing audit services to the organization after the IPO, ensuring that its financial statements remain true and relevant throughout its public life.

Collaboration between law firms and audit firms

Law firms and audit firms draw closely together across the IPO system, sharing information and know-how on how to ensure IPO success. Law firms rely on the expertise of audit firms in accounting and financial reporting, while audit firms value the legal insight and steerage provided by law firms.

The complementary roles of law firms and audit firms are critical to ensuring a smooth and successful IPO for businesses with the criminal and financial knowledge necessary to navigate the complexities of the public markets and protect investor interests.

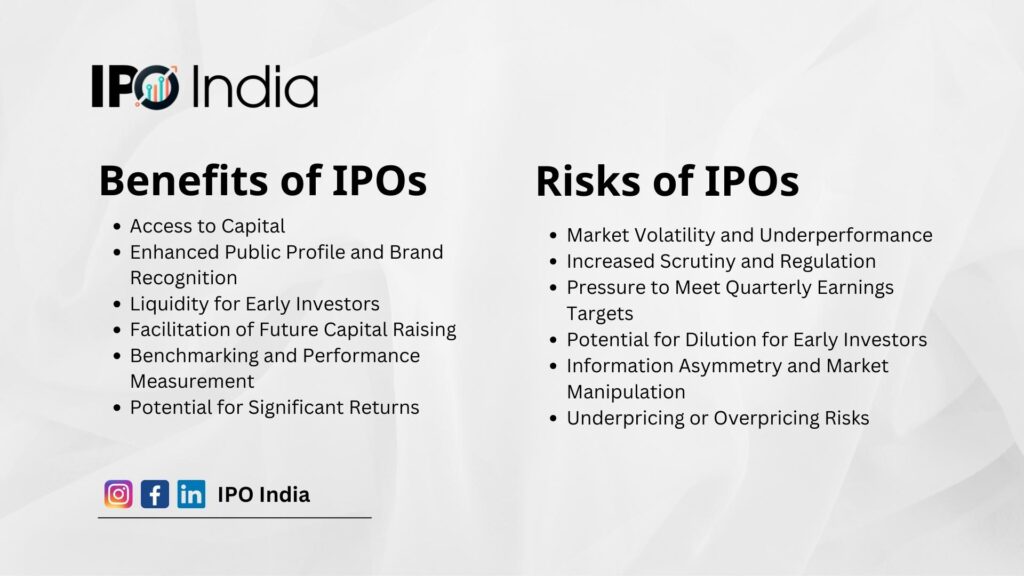

Benefits and Risks of IPOs

An initial public offering (IPO) can be a massive milestone for groups, allowing them to improve capital, expand their operations and enhance their public profile. However, IPOs also have inherent risks that corporations and traders should carefully consider.

Benefits of IPO

- IPOs provide corporations with a large source of capital to expand projects, including expanding into new markets, developing new products, and increasing research and development.

- Going public can significantly increase an organization’s public profile and logo popularity, attracting new customers, partners and talent.

- IPOs offer early buyers and employer founders an opportunity to promote their shares and earn a return on their investment.

- Publicly traded businesses can raise additional capital through a secondary offering, issuing additional shares to existing or new investors.

- A business enterprise’s inventory fee becomes a key indicator of its marketplace’s overall performance and general evaluation, allowing buyers to assess its growth potential relative to enterprise peers.

- A successful IPO can generate huge returns for traders as the organization’s inventory value appreciates and performance increases in response to high-quality market sentiment.

Risks of IPOs

- IPOs can be volatile in the short term, and there is no guarantee that stock prices will increase after the IPO. Companies may also face pressure to meet quarterly earnings goals, which may lead to short-term choices that may not align with long-term bullish techniques.

- Publicly traded businesses face increased scrutiny from regulators, investors, and the media. This may result in increased charges associated with compliance and disclosure requirements.

- Public agencies face pressure to meet or exceed quarterly earnings expectations, which can result in quick-time period preferences that may not be aligned with long-term growth techniques.

- As enterprises issue additional shares through secondary offerings, the ownership percentage of early buyers is reduced, possibly reducing the standard return on their funds.

- The complexity of financial facts and the potential for insider trading can create statistical asymmetries within the market, allowing a few traders to gain an unfair advantage over others.

- The IPO pricing process can be difficult, and there is a risk that the shares may be underpriced or overpriced, resulting in losses to investors or the corporation.

- Initial traders and insiders may be in a position to lock-up agreements, which limit their potential to promote their shares for a unique length of time after the IPO, possibly restricting their liquidity and flexibility.

- The IPO technique can be quite costly in terms of significant legal, accounting and underwriting fees. These prices may reduce the internet revenue the organization receives from the IPO.

Investors should carefully weigh the potential benefits and risks of an IPO before investing in newly public companies. It is crucial to conduct thorough due diligence on the organization’s financial health, enterprise orientation and control group before selecting funds.

Factors to Consider When Evaluating IPOs

Evaluating a Preliminary Public Offering (IPO) involves careful consideration of various factors to make an informed fund selection. Here are some key factors to evaluate when comparing IPOs:

Financial health and stability of the company: Thoroughly analyze the financial statements of the corporation, along with the role of its sales growth, profitability margin, degree of debt and cash flow. This gives insight into the economic performance of the employer and its ability to generate sustainable earnings.

Market Opportunities and Competitive Landscape: Assess the general feasibility of the market for the corporation’s products or services. Assess the competitive panorama, identify key competitors, their strengths and weaknesses, and the organization’s competitive differentiation.

Management Team Experience and Track Record: Evaluate the experience, information and track record of the enterprise’s management crew. Evaluate their potential to implement the agency’s enterprise approach, navigate market challenges, and lead the agency to long-term growth.

Company’s Unique Selling Propositions (USP) and Competitive Advantages: Identify the company’s unique selling propositions and aggressive advantages that set it apart from its opponents. Assess the sustainability of these gains and their potential to translate into market share gains and profitability.

IPO Pricing Related to Valuation and Market Comparables: Evaluate business enterprise valuations and IPO pricing relative to similar corporations within the same industry. Consider factors including price-to-earnings ratios, bullish estimates and market sentiment.

Reputation and expertise of underwriters: Assess the reputation and information of underwriters relevant to the IPO. Consider their track record of hitting IPOs, their ability to generate investor demand, and their dedication to helping the enterprise’s overall post-IPO performance.

IPO Prospectus and Disclosure: Carefully evaluate the IPO prospectus, paying attention to the organization’s financial statements, business enterprise approach, risk elements and control repayment shape. Ensure proper disclosure of capacity risks and required conditions.

Market Conditions and Investor Sentiment: Consider the general market conditions and investor sentiment at the time of the IPO. A favorable market environment and strong investor demand to feed into brand new services could increase the likelihood of a hit IPO.

Lock-up Agreements and Trading Restrictions: Understand the terms of any lock-up agreements or purchase and sale restrictions that may apply to early traders or corporation insiders. These regulations can limit liquidity and affect inventory value in the short term.

Post-IPO Plans and Growth Strategy: Evaluate the company’s put-up-IPO plans and scale up the methodology. Assess how the business enterprise intends to use IPO proceeds and envision and forecast future expansion and market entry.

Remember that IPOs have inherent risks and there is no guarantee of completion. Investors need to do thorough due diligence, not forget their risk tolerance, and seek professional advice if important before choosing a fund.

Check out How to invest in IPOs?

Tips for Successful IPO Investing

Investing in initial public offerings (IPOs) can be a rewarding venture, representing the ability to participate in the initial raising of promising companies. However, IPO investing also involves inherent risks, and should be approached with caution and a well-informed approach. Here are some guidelines for a successful IPO investment:

Before investing in any IPO, do thorough research on the agency, including its financial statements, enterprise strategy, management crew and aggressive panorama. Analyze its market feasibility, aggressive advantages and capacity threats.

Familiarize yourself with the IPO process, including the role of underwriters, the pricing mechanism, and the lock-up period for early traders. Evaluate the IPO price relative to the organization’s valuation and comparable businesses within the industry.

Determine your risk tolerance and investment goals before investing in an IPO. IPOs are riskier investments than established stocks, so make sure they align with your standard funding approach and threat profile.

Don’t keep all your eggs in one basket. Diversify your investments in one-of-a-kind IPOs and asset training to reduce risk and protect your general portfolio.

IPOs are routinely volatile in the short term, so frame them with a long-term funding horizon. Give the employer enough time to implement its enterprise approach and realize its growth potential.

If you are new to investing in IPOs or lack the information to do a thorough study, be sure to seek expert advice from a financial advisor or fund specialist. They can offer steerage and help you make informed investment choices.

Keep abreast of market information and trends associated with the agencies you invest in. Monitor their performance and economic results to assess their growth and potential risks.

Avoid making impulsive choices based on emotions or anxiety about missing out (FOMO). Stick to your funding plan, make rational decisions based purely on research and don’t allow market sentiment to sway your decision.

IPO investing requires persistence and discipline. Don’t be swayed by using short-term rate fluctuations. Stay focused on the long-term growth potential of the organization and continue your investment if you believe the agency’s prospects to be true.

Regularly evaluate your IPO investments and re-evaluate their overall performance in light of recent records, marketplace conditions and changes in the commercial enterprise method of the enterprise. Be prepared to control your holding or exit position if important.

Remember, IPO investing is not a get-rich-quick scheme. It requires careful study, due diligence and a long investment horizon. Approach it with caution, diversification and a disciplined funding approach to increase your odds of success.

Conclusion

Initial public services (IPOs) play a good sized position inside the economic markets, using economic growth, improving market performance, and empowering traders. They offer a mechanism for personal agencies to get entry to capital from the general public, permitting them to fund growth plans, studies and improvement projects, and standard commercial enterprise operations.

The IPO procedure entails a complete assessment of the organisation’s financial fitness, enterprise approach, and normal readiness for the public marketplace. Bookbuilding and pricing are crucial steps in the IPO method, while listing and buying and selling are the final degrees.

Investment banks play a pivotal position inside the IPO manner, whilst law companies offer felony suggest and audit corporations make certain the accuracy of financial statements.

IPOs provide potential advantages consisting of access to capital, stronger public profile, and liquidity for early buyers, however additionally they involve inherent risks consisting of market volatility and underperformance. Investors need to cautiously bear in mind the potential benefits and dangers earlier than making an investment in newly public corporations.

View more article click here

FAQs About “What is an IPOs?”

What is IPO in stock market?

When a private company sells shares of stock to the public for the first time, the process is known as an initial public offering (IPO).

Full form of IPO?

Initial Public Offering

What is IPO example?

An initial public offering, or IPO, is when a private company decides to go public and make its shares available to the public market for the first time. Many well-known companies have gone through the IPO process, such as Meta (Facebook) and General Motors.

The photographs and visuals used in this blog are always stunning They really add a beautiful touch to the posts

sit repellat veniam deserunt saepe sit a. iure occaecati praesentium illo qui enim distinctio quod ipsa ex distinctio. sequi ipsa voluptates aut explicabo. debitis ex voluptatum ea culpa optio assumen

FlixHQ I truly appreciate posts that inspire thoughtful consideration. Also, thank you for letting me share my comment!